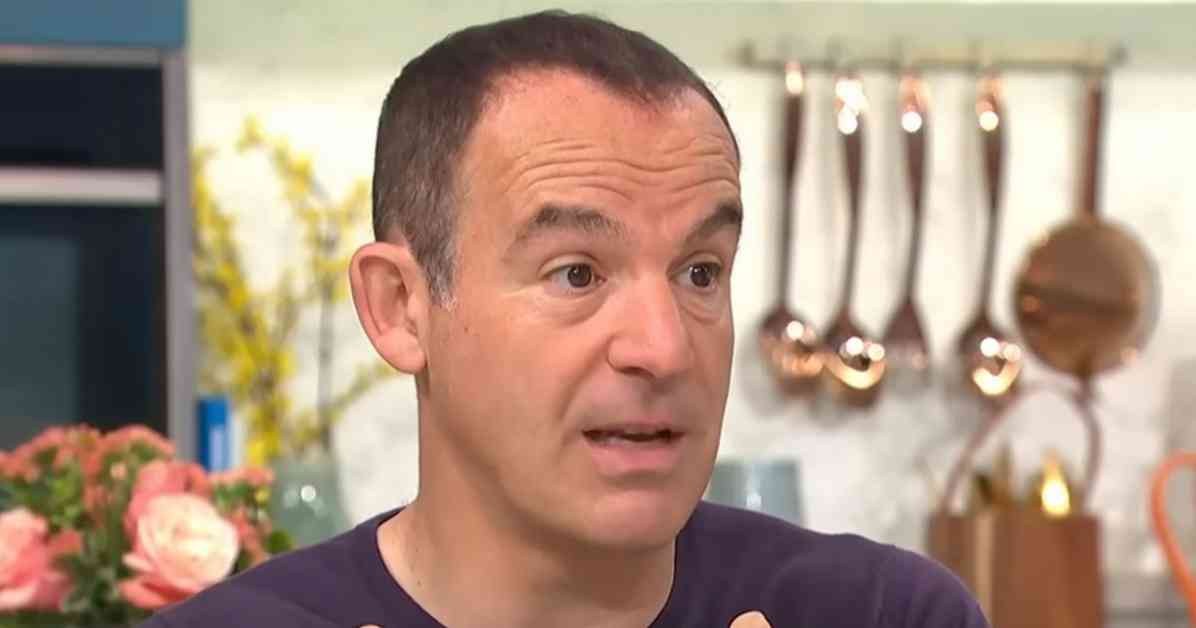

Martin Lewis, a financial expert, recently gave a warning to all credit card users, including those with well-known cards like Barclaycard and Mastercard. He stressed the importance of taking action to secure your finances, especially if you are paying interest on your credit cards. According to Mr. Lewis, it is crucial to explore if you can find a better deal, as he stated on his Money Saving Expert (MSE) website that “you can’t afford not to check.”

One of the key strategies that Mr. Lewis recommended is using a 0 percent balance transfer. This method involves getting a new credit card to pay off existing ones, allowing you to transfer your debt to the new account without incurring interest for a specific period. By doing this, more of your payments will go towards reducing your actual debt, rather than mostly covering interest charges.

To determine which credit cards you are likely to qualify for, Mr. Lewis suggested using the MSE eligibility calculator. This tool performs a soft search, meaning it will show up on your credit file but cannot be used by lenders to evaluate your creditworthiness. When selecting a balance transfer deal, Mr. Lewis advised opting for one that gives you enough time to clear your debt.

If you have the option to clear your debt more quickly, Mr. Lewis recommended choosing a shorter balance transfer deal to minimize fees. However, if you are unsure, it is safer to go for a longer deal. For individuals with a good credit score, Mr. Lewis highlighted some top 0 percent balance transfer deals, such as MBNA offering up to 29 months at 0 percent, Tesco Bank with 27 months at 0 percent, and NatWest providing 13 months at 0 percent.

On the other hand, for those with a lower credit score, Mr. Lewis warned that the Annual Percentage Rate (APR) after the 0 percent period ends could be significantly higher, often around 30 percent. Some deals available for individuals with a lower credit score include Virgin Money offering 16 months at 0 percent, Fluid with 9 months at 0 percent, and Capital One providing 7 months at 0 percent.

Mr. Lewis also emphasized the importance of meeting the minimum monthly repayments when conducting a balance transfer to avoid losing the 0 percent rate. He suggested that individuals with a poor credit score who are considering a balance transfer should take it as a signal to manage their finances more carefully.

In conclusion, taking proactive steps like exploring balance transfer options can help credit card users improve their financial situation and reduce debt effectively. By following the advice of experts like Martin Lewis, individuals can make informed decisions to secure their financial future.